Student Loans

Federal student loans are popular with US students studying in the US, but they are not available to international students. Instead, international students are eligible for international student loans, specialized private education loans available to international students studying in the US.

International Student Loans are now a very realistic way to finance your education in the US. Loans are very flexible, and can offer loan amounts high enough to pay for your entire education, but with extended repayment terms and reasonable interest rates, so you can afford the repayment after you graduate.

More information about cosigners, interest and repayment here

Some of the most popular loan companies are given on this website

Banks

One of the biggest things that you will need to manage when you go to university in the US is your finances. Having a safe place to keep your money is one weight off your mind. There are many banks across the US, as well as different types of accounts. Whether you are an international or a domestic student in the US, it is worth checking out what bank accounts there are available for students.

The steps to successfully choosing and opening a bank account are

1.

Choose a bank

There are many banks in the US, so the best way to narrow it down is to look at what the different banks are offering students and the prevalence of the bank in your state as well as nationally.

2.

Choose an account

There are two different types of bank accounts in the US: a checking account and a savings account.

3.

Breakdown of bank accounts

We are here to build trust with transparency and to ensure that you are treated correctly without having to pay extra.

4.

How to open a bank account

Although it is possible to open a bank account over the phone or online, if you are an international student it might be easier to open your account in person in case there are any complications. When you go to the bank to open your account you will need a few documents which are mentioned in the resource below.

This webpage clearly explains the whole process and makes some choices easier.

Find the list of best banks in Seattle area

Credit Score:

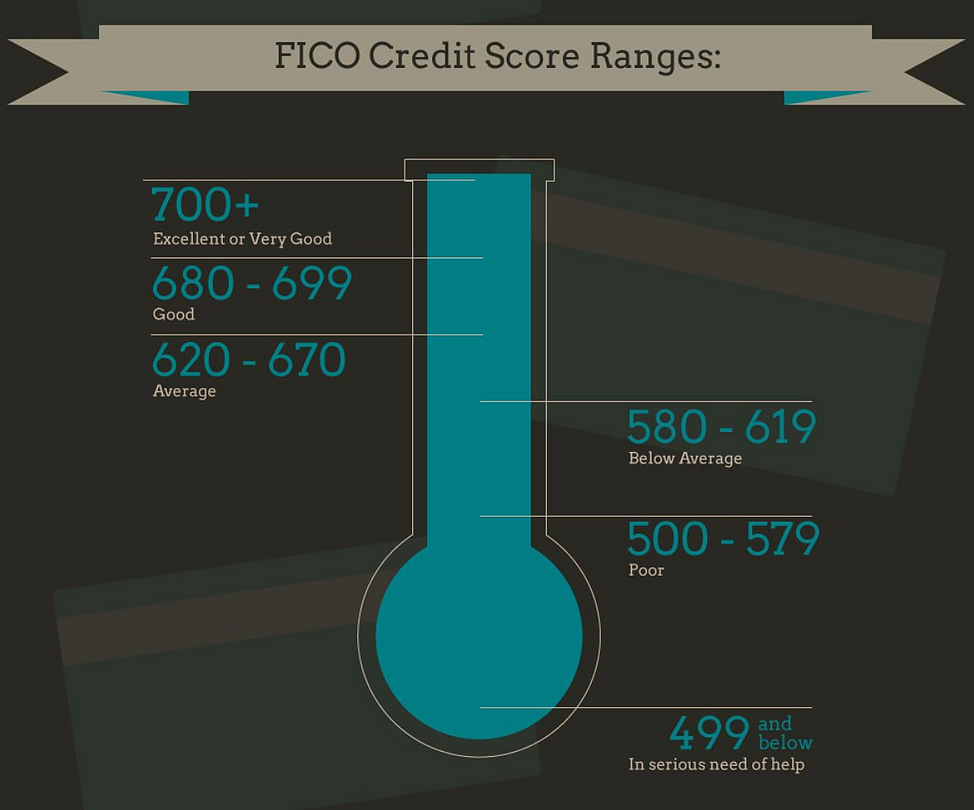

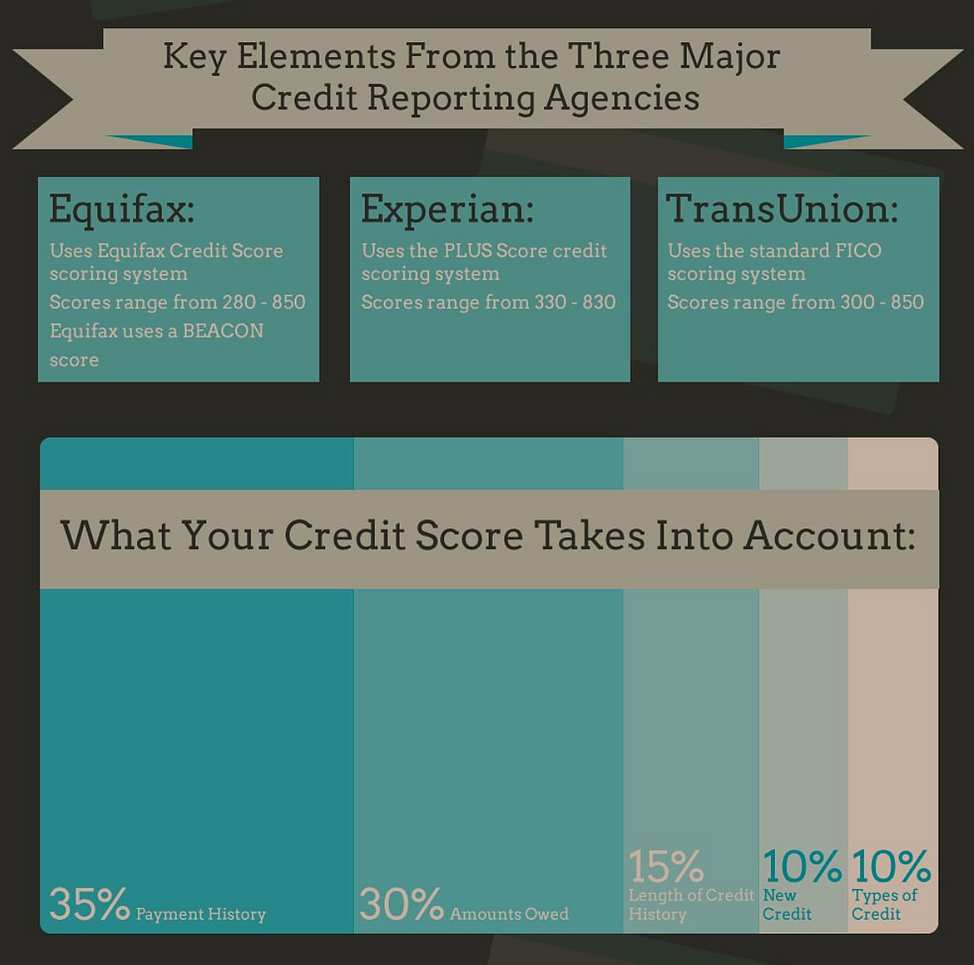

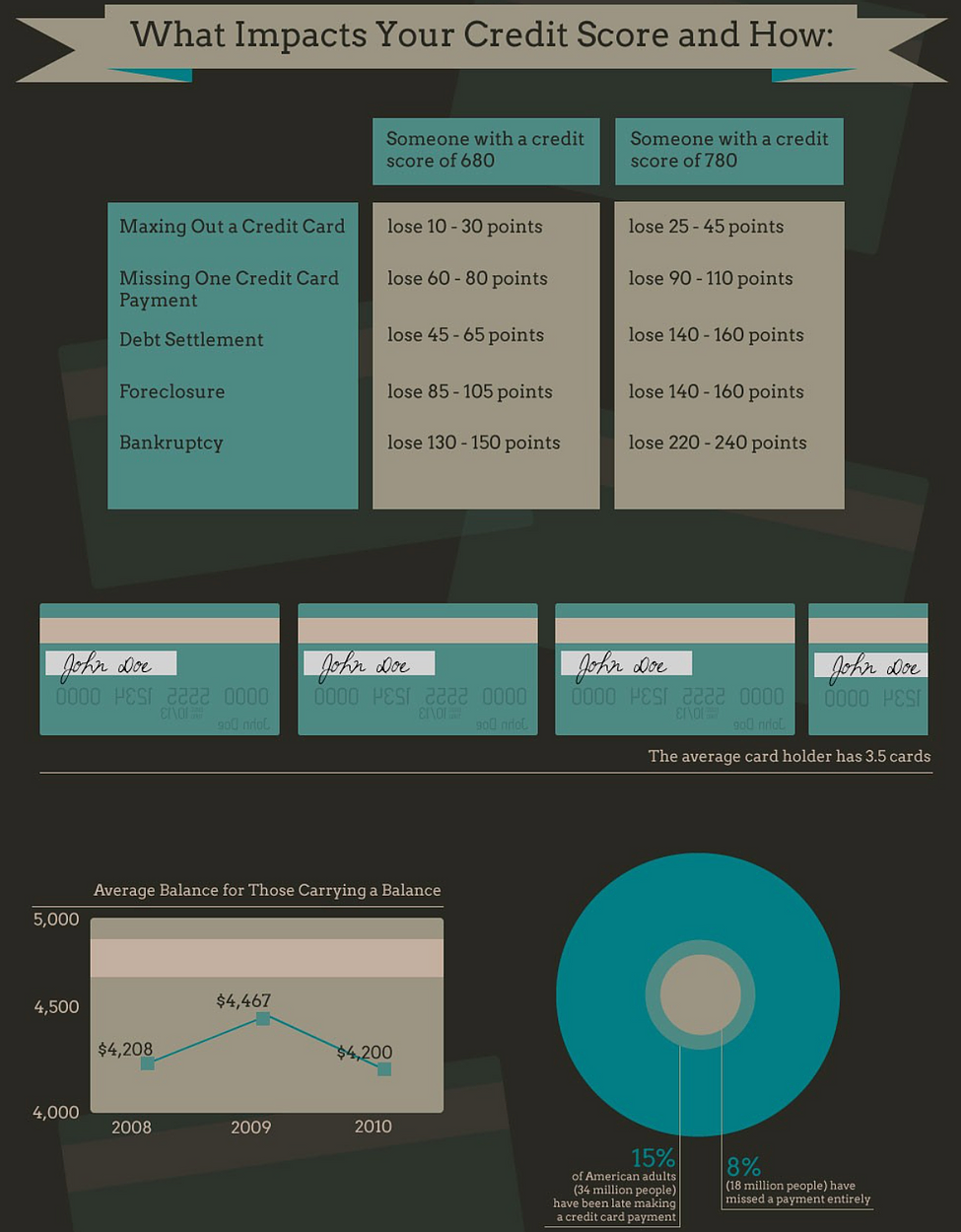

If you haven’t heard of the term “credit score,” it’s one that you will want to become familiar with during your time as an international student in the US. A credit score is a rating given to your financial background when assessed by a lender. When you’re applying to borrow money (like through a loan or credit card) the lender will most likely look at your credit score to see whether you are an eligible candidate. Your credit score basically sums up how much of a financial risk you would be if you were to be loaned money.

Everything you should know about credit scores

Your credit score describes how well you can manage debt and is used by banks to rate how risky you are to loan money to. An excellent credit score can save you thousands of dollars of interest over time while a poor credit score can prevent you from getting loans or credit cards. Understanding credit and what can affect your score is the first step to building an excellent credit score.

More information about credit score here

https://www.internationalstudent.com/study_usa/way-of-life/building-credit/